Why 2022 Will Be a

Strong Year

for Local TV Advertising

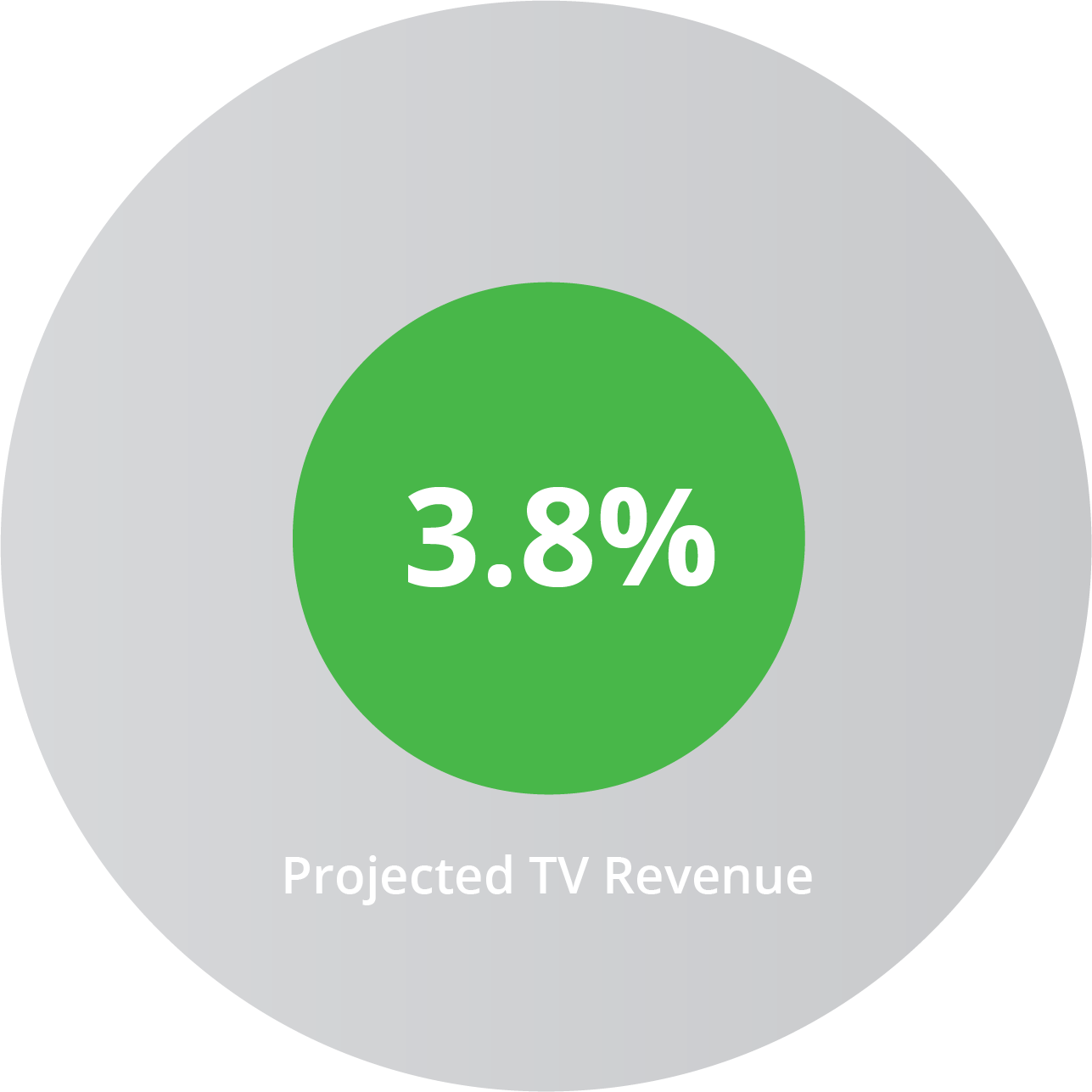

Local TV Advertising Projections for 2022

In the analysis, local TV media comes in No. 4 out of five channels, behind mobile, direct mail and desktop.

For broadcast TV sales professionals, this increase in ad spending is a golden opportunity to engage new local advertisers and retain more share of wallet from current customers.

Verticals Expected to Increase Spend in 2022

What Are the

Key Drivers Fueling

the Projected Increase for Local TV Advertising?

Mid-Term Elections

CTV Will Capture Meaningful Share

How to Capture Political Ad Dollars

Digital Advertising Growth Fueling Resurgence

Why Is OTT So Hot?

How to Gain More Advertiser Dollars for Digital

Forecasted Holiday

Retail Spending

8.5-10%

Positive Economic Signs

Other Positive Signs

Talk to Advertisers About a Healthy Economy

New Advertisers Enter the Local Market

Since the legality is at the state level, advertisers look to local markets versus national advertising options. Nielsen described the opportunity as a “golden goose,” as it’s rare for TV to usher in a new ad category. They go on to report, based on data from BIA, that online gambling advertising skyrocketed from only $19.7 million in 2019 to an estimate of $587 million by 2024. TV accounts for 80% of this category of advertising.

Positioning the Opportunity

Gambling Ad Spend

Biggest Spenders

2022 Winter Olympics

Capitalizing on the Olympic Effect

NextGen TV Offers New Revenue Stream

What Is NextGen TV?

A New Ad Product with Potential

How Will You Capitalize on the Trends Driving Local TV Advertising in 2022?

What Do You Need in Place?

Talk to Our Revenue Experts

Sources: BIA, Axios, Conference Board, NRF, Washington Post, US Bets, Nielsen, NY Times, RBR